| 5.1 |

Recognise Cost Price, Selling Price, Profit and Loss |

|

|

Situation 1

Camera selling price model A = RM 8,200, Camera selling price model B = RM 2,130

The cost price of a Model A camera is RM7 650. How much is the profit?

The profit of a Model B camera is RM250. How much is the cost price?

Situation 2

Capital spend for selling cendol is RM129 whereas the sales is RM85. Calculate the loss that had been suffered by the seller.

- Loss = Cost price – Selling price

- = RM129 – RM85

- = RM44

Situation 3

A car seller suffer a loss of RM 8,950 when he sold his used car because he bought it with the price of RM 42,436.

- Loss = Cost price – Selling price

- RM8 950 = RM42 436 – Selling price

- Selling price = RM42 436 – RM8 950

- = RM 33,486

|

| |

| 5.2 |

Solve the Problems of Cost Price, Selling Price, Profit and Loss |

Situation 1

A food seller incurred losses as much as 15% when the food that he prepared did not sell well on that day. The cost for the food and the workers’ wages is RM2 560. Calculate his loss and the total sales on that day.

| Item |

Cost price |

Selling price |

| Oven |

RM1 450 |

RM1 608 |

| Cake mixer |

RM695 |

|

Solution:

| Profit from oven |

\(\begin{aligned}\\ \small{\color{red}5}\space\small{\color{red}{10}}\space\space\\ \space\space RM1\space\space \cancel6\space \cancel0 \space8\\ \underline{-RM1\space\space4\space5\space0}\\ \underline{\space\space RM \space\space\space\space\space1\space5\space8}\\ \\\end{aligned}\\\) |

| Profit from cake mixer |

\(\begin{aligned}\small{\color{red}1}\space\space\small{\color{red}1}\space\space\space\space\\ \space\space\space RM\space1\space\space5\space\space8\\ \underline{+\space RM\space\space\space\space\space\space4\space\space6}\\ \underline{\space\space\space\space RM\space\space2\space\space0\space\space4}\\ \\\end{aligned}\\\) |

| Selling price of cake mixer |

\(\begin{aligned} \space\space\space RM\space6\space\space9\space\space5\\ \underline{+\space RM\space2\space\space0\space\space4}\\ \underline{\space\space\space\space RM\space\space8\space\space9\space\space9}\\ \\\end{aligned}\\\) |

Situation 2

The picture shows the cost price of two types of caps, A and B. Encik Yusof wants to make a 20% profit from each type of cap he sells. How many caps A and B should he sell to get a profit of RM120 on that day?

Solution:

\(\begin{aligned}\dfrac{15}{10\cancel0}\times\ RM2\ 56\cancel0=\dfrac{RM3\ 84\cancel0}{1\cancel0}\\ =RM384\quad\\ \end{aligned}\\\)

The lost RM384.

Total sales = Cost price - Loss

= RM2 560 - RM384

\(\begin{aligned}\small{\color{red}{15}}\\ \small{\color{red}{4\ \cancel5\ 10}}\\ RM2\space\space\space \cancel5\space \cancel6\space \cancel0\\ \underline{-RM\space\space\space\space3\space8\space4}\\ \underline{\space\space\space RM2 \space\space1\space7\space6}\\ \end{aligned}\)

The total sales obtained is RM2 176.

|

| |

| 5.3 |

Recognise Discount, Bill, Rebate and Invoice |

Discount

- Discount is the price reduction from the original price..

|

|

Bill and Rebate

|

|

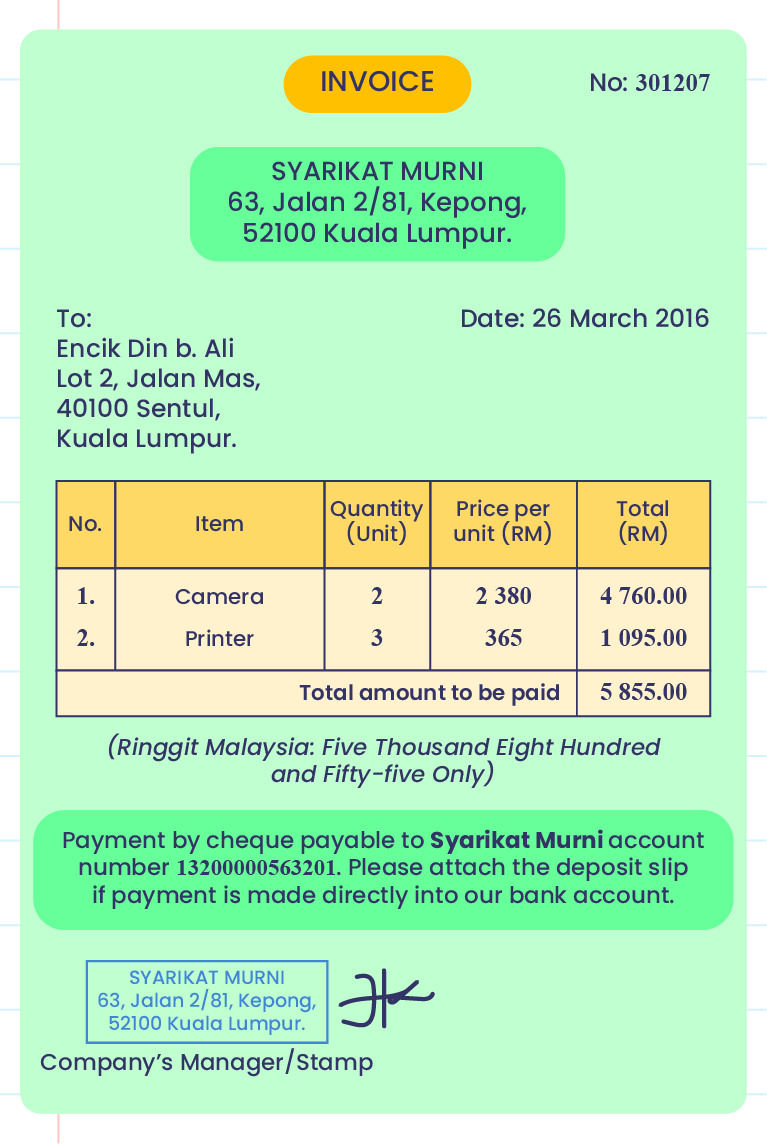

Invoice

|

| |

| 5.4 |

Solve the Problems of Discount, Bill, Rebate and Invoice |

Situation 1

In a watch shop, each customer will enjoy a discount of 20% for each purchase of a wristwatch. Encik Asyraf wants to buy Model P wristwatch. Calculate the amount of money that he will save. How much is the selling price after the discount?

Solution:

Discount:

20% from RM450

\(=\dfrac{2\cancel0}{1\cancel0\cancel0}\times RM45\cancel0\\ =RM90 \)

\(\begin{aligned}\\ \small{\color{red}3}\space\space\small{\color{red}{15}}\space\space\space\\ \space\space\space\space RM\cancel4\space\cancel5\space0\\ \underline{-RM\space\space9\space0}\\ \underline{\space \space RM3\space6\space0}\\ \end{aligned}\\\)

Situation 2

Encik Din makes an order from Syarikat Murni as stated in the invoice. If he orders 2 times the number of cameras of the similar type and 2 similar printers in June, how much is the total payment for the invoice for that month?

| Item |

Camera |

Printer |

| Quantity |

2 x 2 = 4 |

2 |

| Price per unit (RM) |

2 380 |

365 |

| Total (RM) |

4 x 2 380 = 9 520 |

2 x 365 = 730 |

|

| |

| 5.5 |

Recognise Asset and Liability, Interest and Service Tax |

Asset dan Liabilities

- Aset is what is being owned such as cash and property.

- Liabiliti is debts.

|

|

Interest

- Interest is money earned from the savings in the bank.

- Bonus or dividend is another term for the interest offered by a particular financial

institution.

|

|

Service Tax

- Tax needed to be paid on the services provided by certain businesses such as hotels and fast food restaurants.

|

| |

| 5.6 |

Solve the Problems of Asset and Liability, Interest and Service Tax |

Situasi 1

The table below shows the total assets and liabilities of Mrs Chua and Mrs Wong. Who is richer?

| |

Puan Chua |

Puan Wong |

| Assets |

RM120 163 |

RM249 618 |

| Liabilities |

RM39 509 |

RM181 325 |

Solutions:

Puan Chua

Assets - Liabilities

= RM120 163 - RM39 509

= RM80 654

Puan Wong

Assets - Liabilities

= RM249 618 - RM181 325

= RM68 293

|